For this kind of self-build home loan, you'll need to discover a way to pay in advance for products and prices as you won't be reimbursed up until later. A self-build home mortgage lets you borrow cash to build your own residence. You can not make use of a regular household home mortgage to money the building of a new residential or commercial property, so if you have actually constantly desired for developing your residence from scratch, this is the type of loan that you need. When applying for a self build mortgage, you'll normally need to finish a detailed costings form. Additionally, for a cost, one of the broker/lender's cost assessors can do this for you.

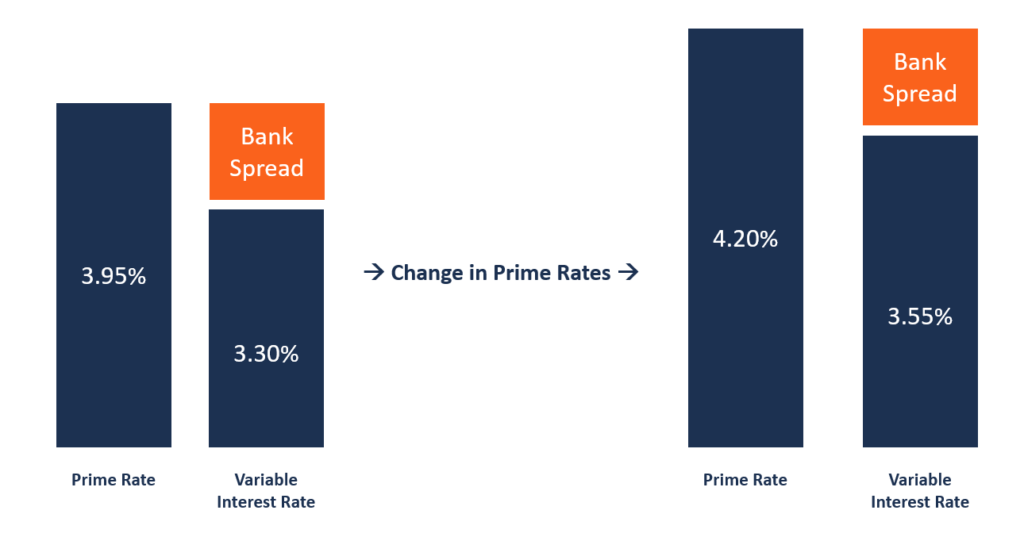

- The payment prices on this housing financing may be adjusted by the lender every now and then.

- If you're preparing to develop an energy-efficient, self-build home, we're right here to aid.

- Our award-winning finance comparison solution makes sure you obtain our benefit rates.

- The firm also supplies 90% of the acquisition cost or 90% of the valuation, whichever is reduced, plus 80% LTV on one-bedroom properties.

A self-build mortgage provides you with the money needed to purchase whatever to build your residence, which can include anything from buying building products to paying professionals and workmen. The cash will only be released as soon as particular stages of the house are complete, for example once the foundations are laid, to make certain that the funds are made use of entirely for the purpose of constructing a home. If you review budget and can not finish the next phase, your home loan lender will not. launch any more cash up until the stage is completed.

Whats The Benefit Of A Price

The total price of loaning is likely to be greater, because of the greater level of danger Visit this website for the lending institution. It is likewise a need that advancement financing is safeguarded on a solitary premium insurance policy. This kind of insurance coverage entails you paying a lump https://www.manta.com/c/mby10ns/wesley-financial-group-llc sum upfront in order to decrease the lending institution's risk additionally, and the premiums can be high. You will normally have to wait to obtain 10 percent of your home mortgage once the job is totally completed.

The Disadvantages Of Self Develop Home Loans

Our team of professionals will certainly direct you through the procedure of securing a home mortgage, purchasing a residence or securing a Safe car loan-- locating the absolute best deals for you and also your family. You will likewise need professional insurance while you're constructing the home, which is one more added price. Additionally, if you finish the develop ahead of schedule and intend to remortgage to locate a lower price, you'll typically require to pay a penalty fee.

The company offers a price cut for structures licensed energy-efficient. Customers can obtain approximately 95% of their land and also build costs, subject to a final optimum LTV of 80%. However, the deposit amount you'll require to supply is likely to be greater than a conventional mortgage. Along with your planning consent and strategies, including predicted expenses for the task. Yes, although the Ecology self-build home mortgage does not launch payments at established building landmark stages (e.g. structure, wall surface plate etc.). We release funds as and when the develop progresses and release approximately a percent of the boosted value of the residential or commercial property.

Instead, with a self-build mortgage the lender releases the money in instalments. These instalments are developed to money each stage of building and construction, so the project is spent for in stages as you accompany. It prevails for the home loan to operate an interest-only basis up until the final release of funds, upon which it switches over to a repayment home loan. The other sort of self-build home loan supplies breakthrough phase settlement. Cash is released to you by your lending institution before you need to pay each expense for work or products, so you do not need to fret about discovering money upfront.

There will certainly be extra documentation, and also you will certainly need to satisfy your lending institution at each stage of the construction process. The government's Assistance to Build scheme may provide debtors the option of better home loan bargains when it is launched. The procedure can be complicated, but the benefit of building your own house is that it can be created specifically to your taste. It might likewise exercise cheaper to develop a residence from scratch than to acquire one totally restored. It's consequently crucial not just that the job satisfies relevant requirements and also proper authorizations are given, however also that you do not spend beyond your means and discover on your own in a setting where you can not complete a phase of jobs.

No Upfront Suggestions Charges

The lending amount depends on offering requirements as well as building products. Self-build home loans can be an excellent device for aiding you achieve your desire residence at an affordable cost. Employing a specialist mortgage broker truly makes a difference when it concerns handling smaller, extra specific niche lenders and also items. Only a limited number of loan providers offer self-build home loans, so you may need to quest around a little bit a lot more to discover the appropriate deal. A mortgage broker can look the marketplace in your place to discover the best one for you.